Flash loans are the edge of DeFi, allowing users to borrow massive sums of copyright in a single transaction, with the entire loan repaid within the same block. This creates a unique ecosystem where innovators can manipulate market inefficiencies and execute complex arbitrage strategies. It's a thrilling landscape where fortunes can be made (or lost) in the blink of an instant. While the potential for innovation is undeniable, flash loans also present significant risks, with vulnerabilities to exploits and manipulation lurking around every corner.

- The DeFi space is always changing, with new projects and applications emerging at a rapid pace.

- Flash loans can be used for a wide range of purposes, from market manipulation to collateralization strategies.

- The transparency of the blockchain makes it difficult to track and prevent malicious activity on flash loan platforms.

Exploiting Lightning-Fast BTC: Maximizing Bitcoin's Pace for Instant Transactions

Bitcoin, once notorious for its delayed transaction speeds, is now undergoing a dramatic transformation. Thanks to the emergence of the Lightning Network, BTC is shedding its perception as a laggard and embracing speed. This transformative technology allows for near-instantaneous transfers, opening up a world of possibilities for businesses.

Imagine sending money across borders in the blink of an eye, or settling microtransactions without any friction. This is now a reality with Lightning Network-enabled BTC. Enterprises can benefit from minimized transaction fees and improved payment processing, while consumers enjoy the convenience of instant payments.

Moreover, the Lightning Network is poised to change a wide range of sectors, from online shopping to gaming. As implementation grows, we can expect an even here more interdependent financial ecosystem, powered by the swiftness of Bitcoin.

Amped-Up Bitcoin : Boosting copyright Trading with Flash Loans

Step into the fast-paced world of decentralized finance that flash loans are transforming a landscape. These short-term, collateral-backed loans allow traders to manipulate price fluctuations in a blink of an eye. Imagine borrowing millions with Bitcoin and instantly activating it for arbitrage opportunities. Flash loans ignite this kind of rapid trading, permitting even beginner traders to participate in sophisticated strategies.

- Yet, the power of flash loans comes with significant risks. Underestimating market movements can lead to devastating losses, wiping out your entire portfolio in a matter of seconds.

- It's a volatile game that demands proficiency and wisdom.

Nevertheless, flash loans represent a revolutionary development in the world of copyright trading. They offer unprecedented opportunities for gain but require extreme vigilance.

Unleash the Power of Instant Liquidity: The Future of Bitcoin is Flash

The blockchain revolution has become, and with it, the demand for instantaneous transactions. Bitcoin, once lauded as a revolutionary technology, recently faces a challenge: scalability. Enter Flash, the game-changer that promises to alter the Bitcoin landscape by offering instant liquidity and smooth transactions.

- Picture a world where Bitcoin transactions are finalized in mere seconds, enabling immediate payments and fostering a more vibrant ecosystem.

- Flash's innovative technology leverages the power of Layer 2 solutions to circumvent the limitations of the Bitcoin blockchain, yielding a more efficient and cost-effective user experience.

- Through Flash, businesses can receive Bitcoin payments with certainty, eliminating the risk of payment delays.

Such advancements have the potential to accelerate mainstream adoption of Bitcoin, connecting the gap between its theoretical potential and practical applications.

DeFi's Dynamite Impact: Flash Loans and Bitcoin's Ascent

The world of decentralized finance has become a captivating arena for both seasoned investors and curious newcomers. At the heart of this burgeoning ecosystem lies a groundbreaking innovation known as flash loans – short-term, collateralized credit lines that empower developers to execute complex transactions with unprecedented speed and efficiency. These fleeting financial instruments have emerged as a key driver behind Bitcoin's recent resurgence, fueling a wave of decentralized applications (copyright) that are reshaping the landscape of finance.

- Within the realm of DeFi, flash loans stand out due to their remarkable swiftness. Executed in mere blocks, they facilitate lightning-fast financial maneuvers.

- inclusive, efficient, and transparent financial services.

- Flash loan activity often results in large-scale market movements as traders utilize these loans for arbitrage opportunities and other speculative strategies.

As the DeFi space continues to mature, flash loans are likely to play an increasingly important role in shaping the future of finance. They offer a glimpse into a world where financial services are more accessible, efficient, and decentralized.

A DeFi Surge: A Deep Dive into Bitcoin's Rapid Finance Revolution

The copyright landscape is constantly evolving, and decentralized finance (DeFi) is at the forefront of this revolution. One particularly novel aspect of DeFi is the rise of flash loans, which are short-term loans that must be settled in a single transaction. This unprecedented concept has unlocked innovative applications for investors looking to exploit marketfluctuations and increase returns.

- However, the speed and scope of flash loan transactions can pose significant risks if not utilized responsibly.

- Consequently, understanding the inner workings of flash loans, their effects on the DeFi ecosystem, and the measures being taken to mitigate risks is vital.

Let's delve into thisintriguing flash loan frenzy and its impact on Bitcoin's finance revolution.

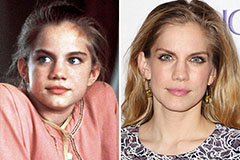

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Hallie Eisenberg Then & Now!

Hallie Eisenberg Then & Now! Burke Ramsey Then & Now!

Burke Ramsey Then & Now! Batista Then & Now!

Batista Then & Now! Jane Carrey Then & Now!

Jane Carrey Then & Now!